By providing a secured and tax-effective cross-border giving framework, Giving Europe builds a bridge between your organisation and prospective donors abroad. By using this bridge, you can:

• Receive tax-free contributions from foreign donors

• Appeal to expatriates

• Approach global partners such as multinational corporations

• Benefit from borderless interest in your cause

• Capitalise on the global exposure offered by an online network

The Giving Europe network does not raise money on behalf of your organisation, but rather enables you to make the most of fundraising opportunities in as many European countries as possible.

Cutting through the red tape

Once approved as an eligible recipient, your organisation will benefit from fiscal incentives to charitable giving provided for by national regulations in the same way as domestic charities. Supporting your organisation will yield the same tax benefits for foreign donors as supporting non-profit organisations in their home country.

Fewer borders, more benefits

Giving Europe enables your organisation to extend fundraising to foreign countries, without having to set up branches or sister organisations and without having to navigate different national laws. Giving Europe offers you the comfort of relying on a support infrastructure managed by leading national foundations with experience in tax laws and the non-profit sector in their respective home countries. Tax questions from prospective donors, gift procedures and donations to your organisation will be handled by Giving Europe partners, ensuring the most effective tax treatment for donors, whether individuals or corporations.

Let us take care of the administration

Giving Europe carries out all administrative tasks related to the tax deductibility of gifts. Depending on the country’s tax laws, Giving Europe partners will fill in all relevant tax forms and deliver, whenever applicable, fiscal receipts testifying to the contribution made.

Who pays what?

Giving Europe retains a contribution on the cross-border gifts channelled through its network. This contribution supports the development of the network through activities such as digital development, finding new partner foundations or providing free practical information on philanthropy in Europe. Our aim is to increase tax-effective giving across Europe and accelerate the establishment of a single market for philanthropy.

Giving Europe retains a contribution on the cross-border gifts channelled through its network. This contribution supports the development of the network through activities such as digital development, finding new partner foundations or providing free practical information on philanthropy in Europe. Our aim is to increase tax-effective giving across Europe and accelerate the establishment of a single market for philanthropy.

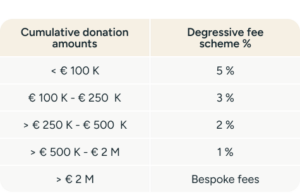

For example, a 5% contribution is applied on gifts up to €100,000 (or the equivalent in another currency), with a degressive fee structure on the donated amount above this mark (see table on the right).